Business Structuring & Advice

Build Smart. Grow Strong. Stay Protected.

Whether you're launching a new venture or restructuring an existing business, Young Law provides strategic legal support to ensure your company is compliant, protected, and primed for growth. We help entrepreneurs, investors, and corporate teams choose the right business vehicle while navigating Jamaica's regulatory landscape.

Business Formation in Jamaica

Jamaica offers several types of business entities, each with distinct legal implications:

Sole Proprietorship – Easiest to form, suitable for single-owner operations, but offers no separation between business and personal liability.

Partnership – Two or more individuals share ownership and liability. Can be general or limited partnerships under the Partnership Act.

Limited Liability Company (LLC) – The most popular choice for SMEs. Offers asset protection, separate legal identity, and is governed by the Companies Act.

Public Limited Company – Suitable for large-scale businesses intending to raise public capital. Subject to detailed disclosure and shareholder obligations.

Our Services Include:

Company name reservation and registration with the Companies Office of Jamaica (COJ)

Drafting Articles of Incorporation

TRN acquisition and compliance setup

Shareholder agreements and partnership contracts

Business license support and tax compliance setup

Corporate governance advisory

Why Choose Young Law?

Regulatory Mastery: We ensure your business structure complies with Jamaican law from day one.

Custom Legal Documents: We draft airtight operating agreements tailored to your industry.

End-to-End Service: From incorporation to growth-stage counsel, we’re your long-term legal partner.

Local and International Expertise: Whether you’re a Jamaican entrepreneur or a foreign investor, we guide you through the required processes smoothly.

FREQUENTLY ASKED QUESTIONS (FAQS)

What is the process for incorporating a company in Jamaica?

The process includes reserving your business name with the Companies Office of Jamaica (COJ), preparing and submitting Articles of Incorporation (Form 1A or 1B), obtaining a Taxpayer Registration Number (TRN), and registering with relevant regulatory agencies depending on your industry. Young Law manages this end-to-end.

How long does the incorporation process take?

Once all documentation is properly prepared, incorporation can take 5–10 business days through the COJ. Our legal team expedites this with accurate filings and timely follow-ups.

Are foreign nationals allowed to own businesses in Jamaica?

Yes. There are no restrictions on foreign nationals owning businesses in Jamaica. However, you must obtain a TRN, and depending on the nature of the business, you may need a work permit or special licenses.

What are the annual compliance requirements?

All companies must file annual returns, maintain proper records, pay taxes, and hold shareholder meetings. Failing to comply may result in penalties or being struck from the register.

Can I convert my sole proprietorship to an LLC?

Yes. You’ll need to form a new company and transfer the assets and obligations from your sole proprietorship to the new legal entity. Young Law can assist in a seamless transition.

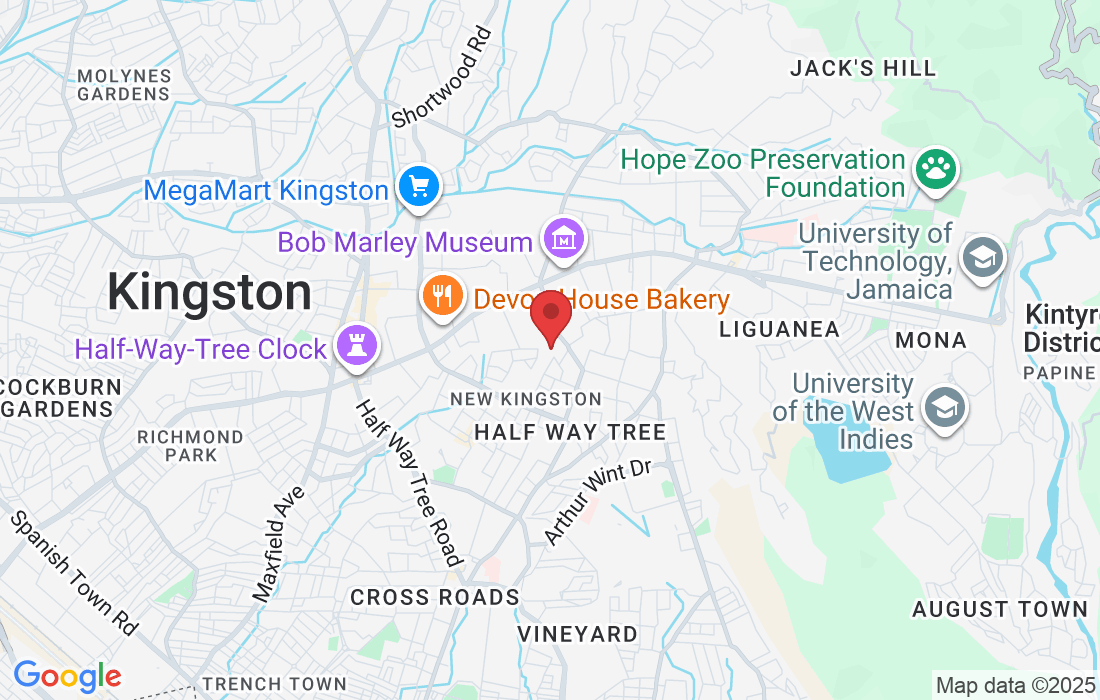

Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.

Our Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.